Why Stablecoins Can't be the Future of Money

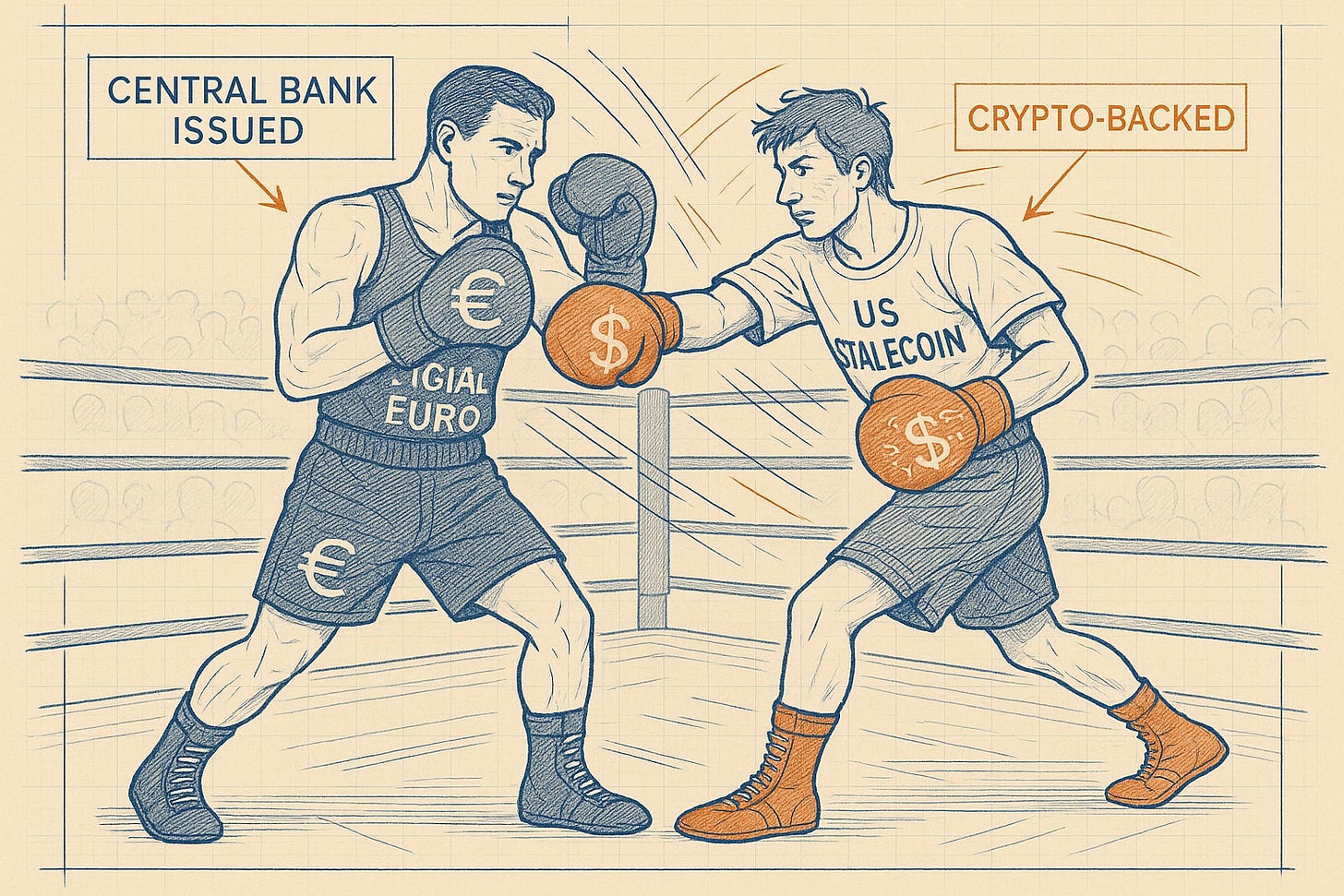

The Digital Euro vs US Stablecoins

If you have a €20 note in your wallet (or in a suitcase from your last visit), you have a credit note which says that the European Central Bank owes you 20 of something called a “Euro”. The same with US dollars as a credit note from the Federal Reserve, Japanese Yen as a debt owed to you by the Bank of Japan, etc.

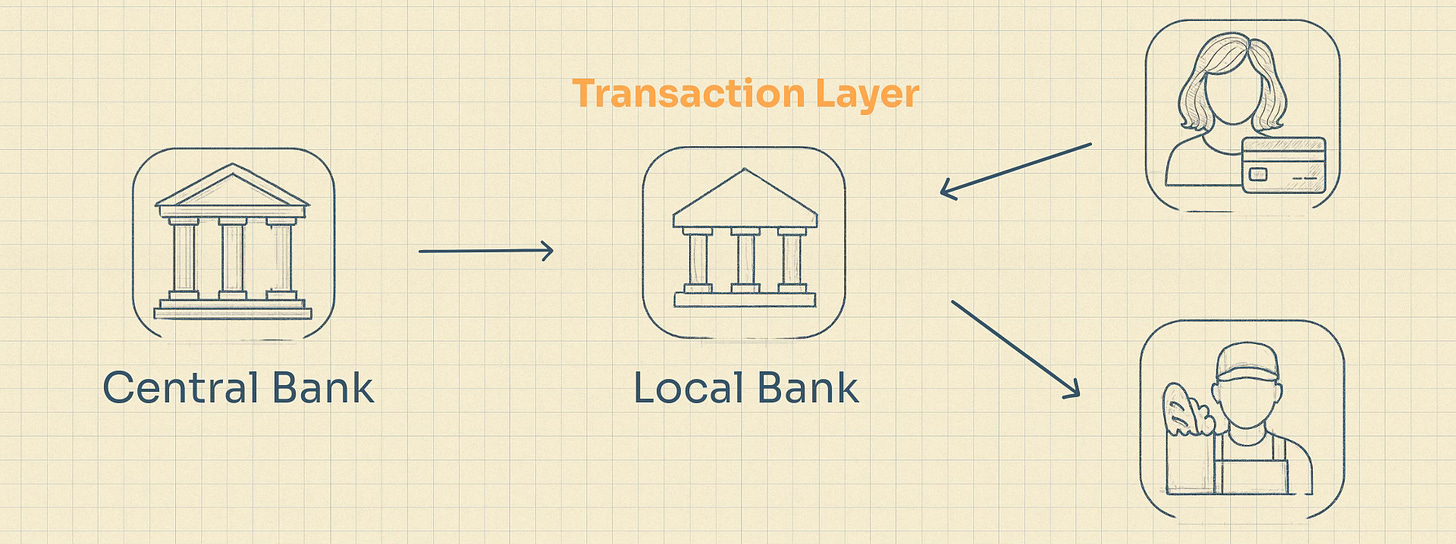

If you deposit your €20 in a local bank, you are technically loaning it to the bank. Now the European Central Bank owes the local bank 20 Euro, and the local bank in turn owes you.

This is recorded by the bank on a fancy spreadsheet (ledger). You can see this debt the bank owes you by logging into your banking app and seeing “€20” listed under “balance”.

Now that you have a digital balance with the local bank, you can buy milk from your local grocer just by telling the bank to move numbers on their spreadsheet from your row to the grocer’s. A tap of a card (or phone, or watch) sends this instruction.

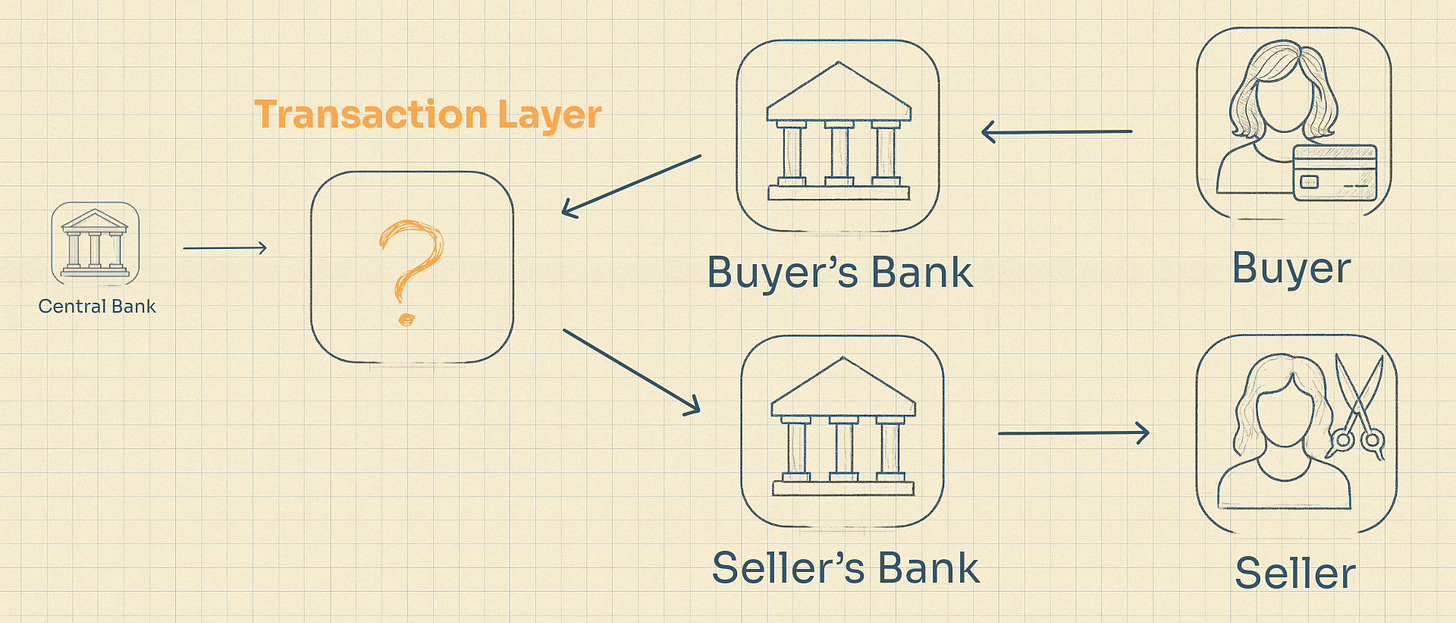

But what happens if you want a haircut, but you and the hairdresser don’t have accounts with the same bank? Now you need to tell your bank to lower your balance, but also tell the hairdresser’s bank to add digits to her balance. Then the banks need to work out how to transfer ECB debt between themselves.

This might be workable between two banks - making a commercial agreement, setting up a technical integration and designing a communications protocol - but once you try to scale this to all the banks in a country, or between countries, there’s just too many bilateral connections needed.

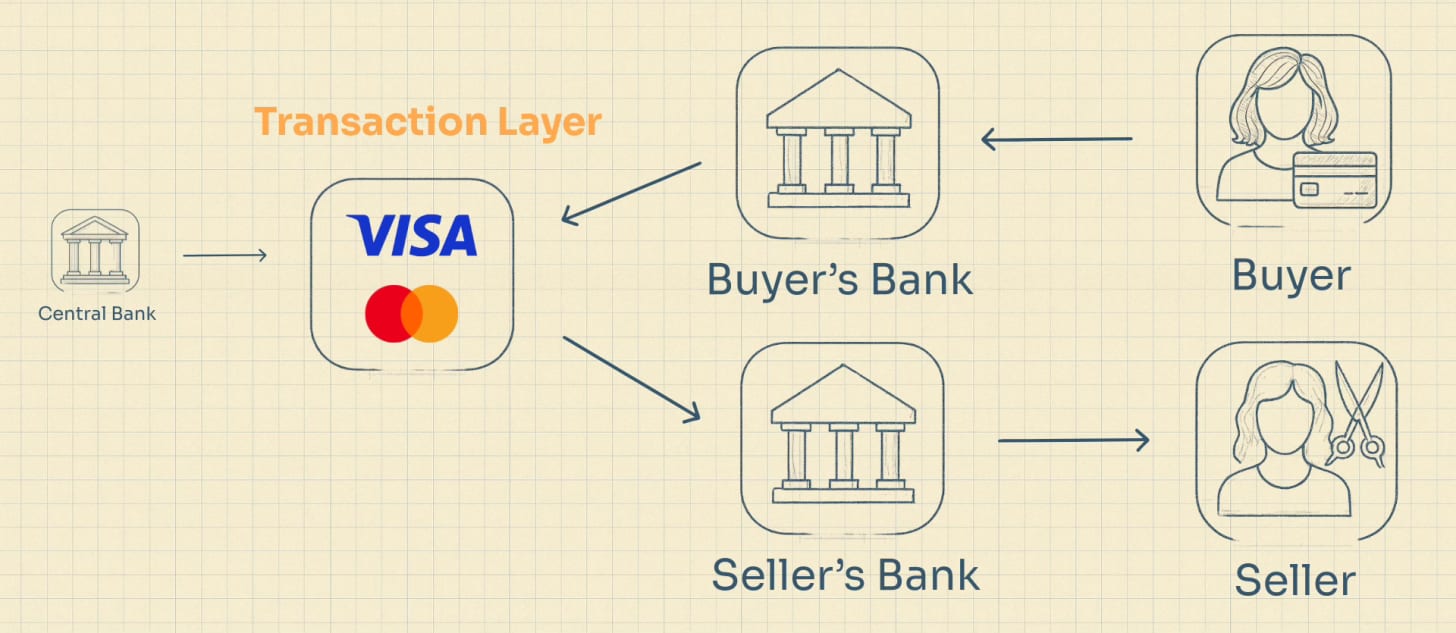

This is where private entities like Visa and Mastercard (US companies) come into play, and the SWIFT communications standard and network. Just as the local bank could act as a transaction layer between you and the grocer, Visa and Mastercard act as a transaction layer between banks.

Europe is Dependent on the US

You might see the problem here for Europe, being overly dependent on US firms which take a cut of almost every digital transaction happening within the Eurozone. From the FT:

"The fact is that the Eurozone is already shockingly dependent on American payment mechanisms. Some two-thirds of card payments in the Eurozone are processed by non-European card providers, says the ECB; 13 of the 20 countries using the euro do not have national card-payment systems. In those cases, “when you go to buy milk, it’s either [physical] cash or Visa/Mastercard”, as one European central banker puts it. This dependence is replicated in the rapid spread of mobile apps.”

This has always been a challenge, but 3 recent changes are making it worse:

Under the Trump administration, the US has become more actively hostile to EU interests. Being dependent has been upgraded from a nuisance to a vulnerability.

The US has been using the SWIFT system to punish adversaries. This has mostly had EU support (e.g. to punish Russia), but coupled with US hostility to Europe would suggest the prudence of having a backup plan.

Stablecoins - a type of cryptocurrency - are exploding as a new intermediate layer (alternatives to Visa & Mastercard) and they’re entirely linked to the US Dollar.

The New US Approach - Stablecoins

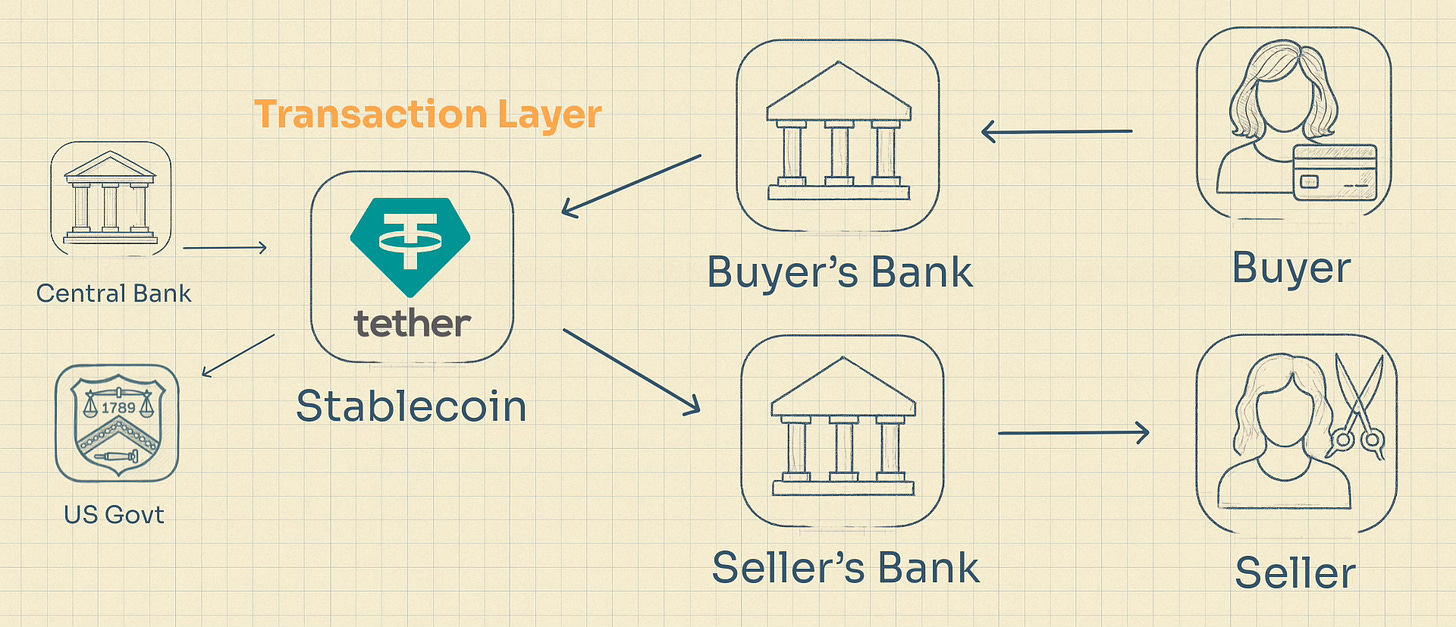

Stablecoins are a form of cryptocurrency “pegged” to a central bank currency. So if you buy 1 of the most popular stable coins, a “Tether” coin, you are loaning the Tether company 1 US Dollar and they are keeping it safe for you. They will also credit you with “1 tether” on a ledger. Not their ledger, like a bank would, but a distributed ledger on one of the crypto blockchains.

This is similar to the bank scenario above, but unlike a bank, they won’t turn around and lend it out as a car loan or a mortgage. What they usually do is lend it to the US Government, by buying treasury bonds, and they make their money off the interest.

That looks something like this:

So if you convert the €20 in your bank to $22, then buy 20 USDT (the symbol for Tether), you can send one or two ofthem to the grocer to buy some milk, if the grocer accepts USDT. When you want to do a transaction between the spreadsheets (ledgers) of banks, you don’t do it through Visa’s single spreadsheet (ledger), you do it through the distributed ledger of the blockchain.

In theory, this can be instant (although currently it takes 5-10 minutes, or up to 30 minutes at busy times). In theory, this can also be very cheap (although currently its $1–$9 per transaction).

So they’re slower than a Venmo and more expensive than Visa and Mastercard, but it’s crypto so of course taking off like wildfire. From the World Economic Forum:

“The use of stablecoins has increased in recent years with the average supply of stablecoins in circulation increasing roughly 28% year-over-year. Total transfer volume, meanwhile, hit $27.6 trillion last year, surpassing the combined volume of Visa and Mastercard transactions in 2024.”

The combined volume of Visa and Mastercard!! Wow.

What’s driving this volume? There must be more to this than just crypto hype? Paul Krugman says that crime is a large part of it:

“But if crypto has no legitimate uses, why are crypto assets worth more than $3 trillion? [....] While crypto has failed to find legitimate uses, it has flourished as a vehicle for illegitimate uses: extortion, money-laundering and, as we’ve seen, bribes to politicians.

Finally, crypto has in effect bought itself huge political influence. This influence-buying is, alas, bipartisan. As far as I know, none of the pro-crypto Democrats who will probably put the GENIUS Act over the top next week is personally on the take the way Trump is. But they wouldn’t be sympathetic to a fundamentally fraudulent industry if it weren’t for the large campaign contributions that come from defending the Big Scam.”

That’s undoubtedly a part of it. I think, however, that the primary driver is demand from parts of the world without stable currencies or sophisticated transaction infrastructure. From Cornell:

“Stablecoins have emerged as a compelling option for cross-border payments and wealth preservation in non-dollarized economies. As high inflation rates erode savings, a common strategy is to rely on the U.S. dollar. However, banks and other financial institutions often provide limited solutions in these economies, making stablecoins a vital alternative for the average person in emerging markets. This highlights the growing importance and utility of stablecoins in providing economic stability and accessibility where traditional financial systems fall short.

According to blockchain firm Chainalysis’s 2024 Geography of Crypto Report, India, Nigeria, and Indonesia stand out as the top countries in these emerging markets for their high levels of stablecoin usage. India is leading in overall and retail-sized cryptocurrency transactions, including those involving stablecoins. Nigeria is not far behind, particularly noted for using stablecoins to enhance cross-border payments and preserve wealth against currency devaluation. Indonesia also ranks high, primarily using stablecoins in DeFi applications.”

The US is Enthusiastic

Stablecoins are inherently risky. When someone gives you a note or a token to represent a debt they owe you, that’s private money. Private money is always at risk of default or runs. When it’s dress it up in such a way that it *feels* like central bank money, people start acting like private money (risky) is central bank money (far less risky) and bad things usually follow..

Although the major stablecoins have been robust so far, it’s not guaranteed that they will maintain their “peg” to the dollar. If you buy them, you’re ultimately lending the Tether guys your money and trusting that they’ll keep it safe.

This risk is obviously worth the tradeoff for many who don’t have access to a stable currency and cheap, quick transactions. I can see the appeal for people and businesses in these countries.

But that doesn’t describe the US, so what’s in it for them?

I think a huge amount of the enthusiasm is also an attempt to lock in dollar dominance. Because each purchase of a stablecoin results in the purchase of a dollar or US government debt. This means that any foreign entities wanting to use the stablecoin layer for quick transfers must first buy dollars to make the transaction. From Cato:

“Today, 99% of stablecoin market capitalization is pegged to the dollar. These digital assets are creating enormous new demand for US treasuries.

In fact, the world’s largest stablecoin issuer was the seventh largest purchaser of US Treasury debt in 2024, surpassing Germany, South Korea, and Canada. This newly created demand can help fill the void left by foreigners exiting US debt markets.”

The Trump administration is pushing this approach aggressively. Two bills aimed at normalizing and regulating stablecoins (the STABLE and GENIUS acts) are currently making their way through Congress.

The US is taking on risk here. Stablecoins are private money. Unlike balances in a bank, they are not guaranteed by the Federal Deposit Insurance Corporation.

Funnelling your financial transactions through a slow, expensive and risky system of private money seems like an unwise gamble to me, but I am not a STABLE GENIUS, so what do I know?

So where does that leave Europe? Will it follow the path of the developing nations and grow to rely on the risky, US dominated stablecoin infrastructure? Even if US Stablecoins remain crisis-free for only a couple of years, it will still put massive pressure on the European system. From Christopher Waller of the US Fed:

“We are hearing increased industry focus on the "stablecoin sandwich" model of cross-border payments, in which fiat currency in one country is converted first into a U.S. dollar stablecoin, then that stablecoin is transferred to another individual, and then finally the stablecoin is converted back into the local fiat currency at its destination. This has the potential to reduce the complexity of a series of correspondent banking networks, improving transparency, cost, and timeliness.”

If this works, even more transactions will be done through USD, not Euro. Buying milk in a grocer in Greece might be facilitated through their network, with their transaction cost, taking on unnecessary levels of risk and providing cheap credit for the US Government.

The Alternative - A Digital Euro

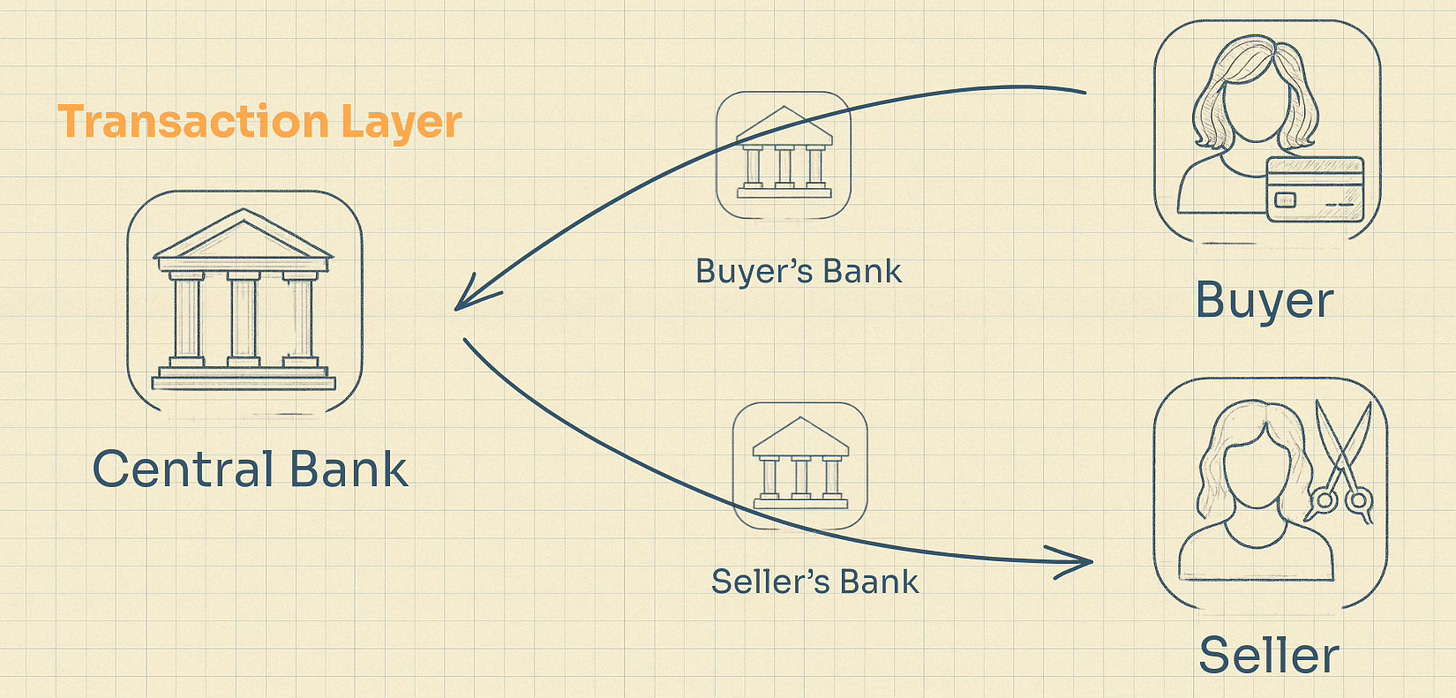

If one option is to use a new private money between the local banks and the central bank, which facilitates transactions in a single (distributed) ledger, and adds a lot of risk to the system, what is the alternative?

Well you could just have a single (centralised) ledger managed by the central bank, open and available to everyone.

Imagine this scenario - every citizen and business in the Eurozone has a digital balance with the ECB. It’s just like cash (a direct debt from the ECB), but recorded digitally, rather than on paper or coins.

When you open your banking app (maybe from a traditional bank, maybe from a fintech), you see your “balance”, but it’s not showing you money that you’ve lent to the bank (“deposited”), it’s just showing you your ECB account balance.

All inter-bank payments (from you to the grocer or the hairdresser) are just movements within the ECB’s ledger. All inter-bank payments are instant and zero/low fee. No blockchain. No gas fees. No risk.

For Europe, this is the way. The plans are already in motion.

It will be tricky, mostly because we require banks in the Eurozone to have big customer balances as proof of their ability to make loans, so we’ll have to find ways to substitute “having deposits” with “facilitating ECB deposits” to make the transition work.

To be clear, it won’t challenge USDT for global dominance in the first instance, because it won’t really facilitate international payments, but it will help Europe avoid having to rely on that system.

It also doesn’t preclude a Euro-tethered stablecoin emerging (and the EU passed it’s regulations last year), nor does it preclude a US Central Bank Digital Currency (although the House Financial Services Committee just passed a bill to prevent this).

And who knows, maybe in 5 or 10 years time, when the ECB is ready to allow non-Europeans to open accounts and the US Stablecoin system has a major crisis causing a run, the digital Euro might be ready to assume global primacy.

This newsletter will be tracking every major step of the race between these two new technologies hoping to re-invent money. Subscribe for free:

Your NOT a greedy piece of shit? Then Bitcoin is not for you. The Crypto industry as a whole doesn’t need you ethically nonsense. Good day Sir, I said Good Day.

There is a missing dimension. If every coin is backed by exactly a dollar, there is no need for treasury backing. Those dollars aren’t loaned out as risk capital, and they are not paying interest to the coin holders, so they should not have spread or liquidity exposure.

The issue is that Trump and many dems want to use the dollar to back speculative coins like Bitcoin. This will destroy our currency, as the value of all bitcoin is astronomical. If there were a run and we tried to defend it, it could easily devastate the dollar.